Instead of forming a designated innovation lab like many of its peers, Bank of America focuses on “citizen innovation,” which it credits with driving its patent supremacy: It says it has more US patents than any other financial services firm and has consistently broken its own quarterly records.

In total, Bank of America has 5,556 patents pending or granted from 6,500 inventors based in 43 states and 14 countries, across all eight lines of its business, it said.

Bank of America’s patents aim to either solve for an immediate need or position the company to meet the future needs of its clients, a spokesperson told Insights Distilled. For example, a recently granted and currently in-use patent allows its clients to quickly provision a new card number to their digital wallet and identify transactions from the card during the authorization process. Its blockchain-related patents, meanwhile, largely aren’t engaged due to the regulatory uncertainty around banks and crypto.

Historically, Bank of America’s patents have been cited more than 43,000 times (you can see a list of the its patent IDs here).

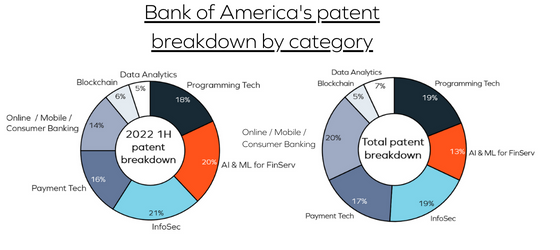

Here’s the make-up of BofA’s patents in the first half of 2022 and overall:

Data via Bank of America. Charts via Insights Distilled.